Overview

This document describes the setup and integration of QuickBooks Online with Heartland Restaurant. You can use the QuickBooks integration feature to export a location’s sales information for sales receipts and journal entries. Sales receipts will link to a designated customer to track all general sales data broken down categorically by General Sales, Discounts, Adjustments, Loyalty Rewards, Taxes, Room Surcharges, Payments and Tips. Journal entries include totals of various sales transactions performed within a designated period of time.

QuickBooks Online

In this method, you can set up and map items for QuickBooks within the Heartland Restaurant’s Admin Console. QuickBooks can be set up prior to the integration within the QuickBooks Item List and QuickBooks Customer Center.

Connecting QuickBooks Online

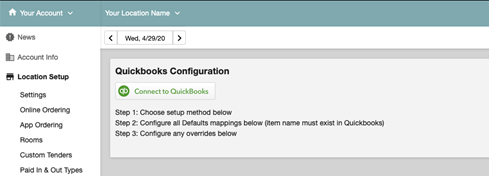

- In the Admin Console’s Main Menu, click Location Setup, then click Quickbooks.

- Click Connect to QuickBooks.

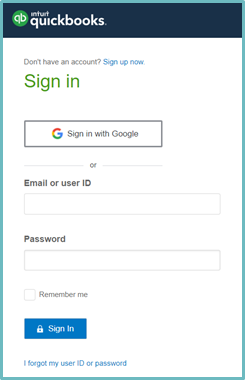

- The QuickBooks Login Page will appear in a new tab. Log in to QuickBooks with the appropriate credentials.

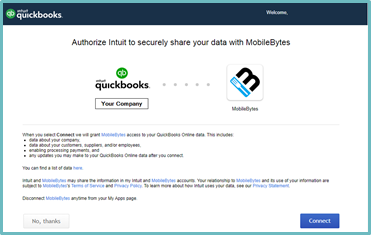

- Once logged in, you will need to authorize data to be shared between QuickBooks and Heartland Restaurant. Select Connect in the bottom right to complete this.

QuickBooks Online Configuration Mapping

Once you have signed into QuickBooks Online, you can map the transactions to the appropriate QuickBooks accounts in Heartland Restaurant’s Admin Console. This method differs from the QuickBooks Desktop Integration method in that the QuickBooks Online communication is direct. If you configure the export settings in the Admin Console, you do not need a password or the QuickBooks Web Connector.

To access the QuickBooks settings in the Admin Console, click QuickBooks in the Main Menu.

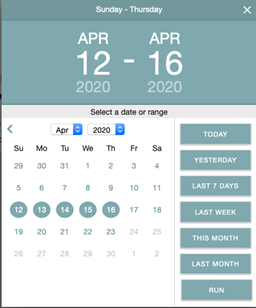

At the top of the QuickBooks screen, if you select the Date Range box, the program will display a calendar window, in this window, you can select a date range of one or more days. If you select a date range, the program will only include the data of transactions performed within that date range when you run the export.

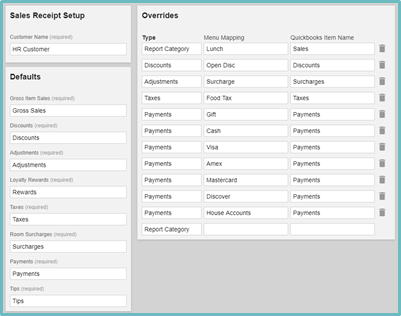

Configuring Sales Receipt Exports

You can configure Heartland Restaurant to export sales receipt information to QuickBooks. In the QuickBooks Configuration area, click Sales Receipt. The Admin Console will display the sales receipt export settings. These settings enable the transfer of data between the Heartland Restaurant Admin Console and the QuickBooks Company File.

A Customer will need to be created inside QuickBooks for the Sales Receipt to append to. The customer must be set as nontaxable. Also, Items will need to be created in the Item List in QuickBooks to map to the Configuration Page in the Admin Console. We also suggest using alphanumeric characters only when creating item names as special characters may cause an error in the export.

There is a Default Mapping that the QuickBooks Items will be mapped to on the Configuration Page in the Admin Console. All of the supported products and services created in QuickBooks are available in the various mapping lists. You must map all entries accurately, or the program will be unable to export sales information.

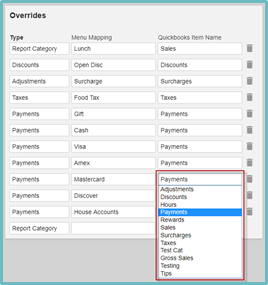

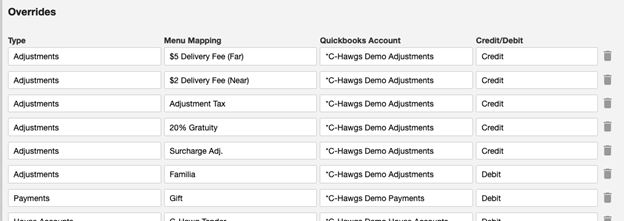

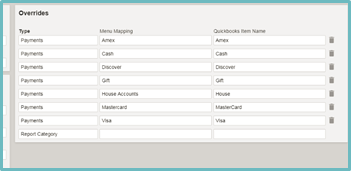

If further specification is needed past these defaults, the Overrides section on the Quickbooks Configuration Page in the Admin Console can be used. A good example of using overrides is with Payments. ‘Payments’ is a default selection to be mapped but, they can use the Override Payments to further breakdown credit card types. The override types directly correlate with the location’s database. For example, if you select Taxes in the Override Type list, its Menu Mapping list will include a selection of the taxes that have been created in the Heartland Restaurant Menu.

NOTE: Currently if this exceeds 100, you will need to change the naming of the products you are creating to map so they are populated over to the dropdown list.

When mapping the overrides with the online integration, it will display the same products and services as the Defaults lists.

If you make any additions to the QuickBooks Online products and services, you will need to refresh the QuickBooks screen for the new products to show in the setting lists.

Configuring Journal Entry Exports

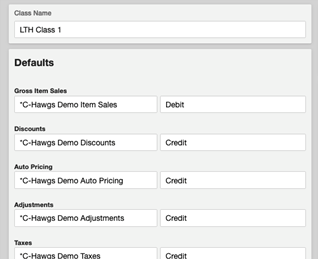

You can also configure Heartland Restaurant to export information for QuickBooks journal entries. In the QuickBooks Configuration area, click Journal Entry. The Admin Console will display the journal entry export settings.

In the Class Name list, select an appropriate class. Each location should have a dedicated class. When you select a class, the program displays the settings specific to its location in the other areas of the screen.

The Defaults area includes various lists, each one representing a type of transaction. In each list, you must select the QuickBooks account that matches the account set for each transaction type in this class (as defined in the QuickBooks setup).

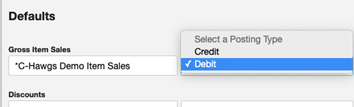

Each transaction type list in the Defaults area also includes a Posting Type list. For each account, select whether the transactions are Credits or Debits. In the journal, credits represent positive amounts and debits represent negative amounts. Again, just like the default accounts, the posting type settings must match the settings in the QuickBooks setup.

The Over/Short Defaults area includes an Account list. In this list, select the QuickBooks account that you have set in the QuickBooks setup to record the location’s overages and shortages. In the Over Label box, select a label for overage totals in the location’s journal entry. In the Short Label box, select a label for shortage totals in the location’s journal entry.

The settings in the Defaults and Over/Short Defaults area are required for the export to function.

In the Overrides area, you can set the program to export specific types of transactions to a QuickBooks account other than the accounts set in the Defaults area. In the Type list, select the type of transaction you want to override. In the Menu Mapping list, select the specific transaction (such as a specific charge, payment, or other reported item) that you want to override.

In the QuickBooks Account list, select the account in which the transaction will be recorded in the QuickBooks journal entries. In the Credit/Debit list, select whether the transactions in this override are Credits (positive amounts) or Debits (negative amounts).

QuickBooks Online Exporting

The QuickBooks Online export is automatically run approximately 1 to 2 hours from the End of Day value set under Location Setup → Settings → App Settings in the Admin Console.

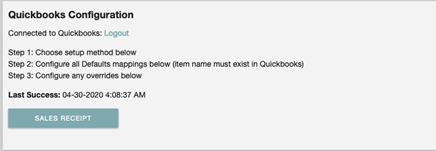

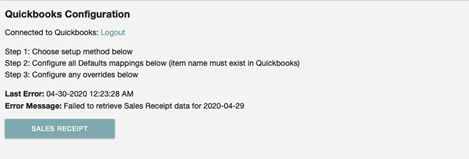

You may alternatively run a Test Export with the Date Selector box on the Heartland Restaurant Quickbooks configuration screen. This will allow you to run the export for a specific date. Once the export has completed you will see the pop up Export Successful at the bottom right of the Admin Console. You will also receive a status indication of the last export that was run.

at the bottom right of the Admin Console. You will also receive a status indication of the last export that was run.

If there was an error with the export, this status will also display a description of the error.

QuickBooks Desktop

The QuickBooks Desktop Integration connects via the QuickBooks Web Connector. This allows the transfer of data between the Heartland Restaurant Admin Console and the QuickBooks Company File.

A Customer will need to be created inside QuickBooks for the Sales Receipt to append to. The customer must be set as nontaxable. Also, Items will need to be created in the Item List in QuickBooks to map to the Quickbooks configuration screen in the Admin Console. We also suggest using alphanumeric characters only when creating item names as special characters may cause an error in the export.

There is a Default Mapping that the QuickBooks Items will be mapped to on the Configuration Page in the Admin Console. If further specification is needed past these defaults, the Overrides section on the Quickbooks configuration screen in the Admin Console can be used.

A good example of using overrides is with Payments. ‘Payments’ is a default selection to be mapped but, they can use the Override Payments to further breakdown credit card types.

After all mapping is complete in Heartland Restaurant, the Web Connector will send the data to the Company File. In the Web Connector, you can choose a Communication Interval; a common interval period is two hours. There is also an option to manually trigger the communication at any time through the Web Connector.

Setup

QuickBooks can be set up prior to having the integration enabled with Heartland Restaurant via the QB Item List and QuickBooks Customer Center. Once everything is configured, you would translate the mappings over to the Quickbooks configuration screen in the Admin Console.

Or

The mappings can be configured first on the Quickbooks configuration screen in the Admin Console. Once the mappings are complete, they can be copied over to the QB Item List. Every mapped QuickBooks Item will need to match exactly on both the Heartland Restaurant and QuickBooks side. It is recommended to copy and paste the naming so nothing is missed.

Quickbooks Configuration Page

Once the Quickbooks integration is enabled & the password is created. You will have access to the QuickBooks screen in the Admin Console. In the Main Menu, click Location Setup, then click Quickbooks. Follow the configuration steps on the Quickbooks screen.

NOTE: The QuickBooks Web Connector application can be obtained from this link. It is important to use the latest version that aligns with your version of QuickBooks.

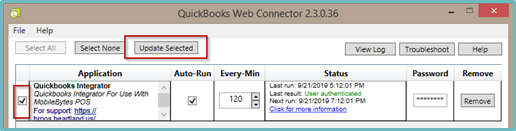

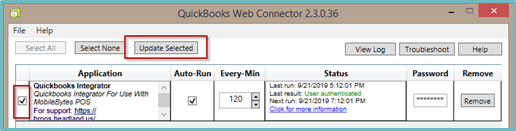

QuickBooks Web Connector

Once the Web Connector is downloaded and installed you will want to make sure all of your items are created in QuickBooks and mapped in the Configuration Page. The Web Connector will act as a communication link between your Company File and Heartland Restaurant. It is important to note what version of the Web Connector supports your version of QB.

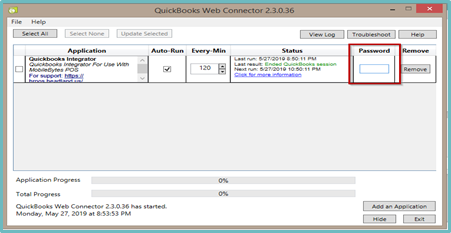

- After the web connector is installed you will be prompted to Authorize the communication with you Company File. Select OK to proceed.

- The Web Connector application will now open. Set the password provided to you for the location in the Web Connector Password.

- To save the password check the check box to the left of the Heartland Restaurant integration and then select Update Selected at the top.

- After you save the password, your QuickBooks Company File you will be prompted to allow communication via the Application Certificate. You must select a ‘Yes’ option to communicate with the QuickBooks company file.

Here are the results of each option selected.

- Yes, Prompt each time.- QuickBooks must be running and you will see this box prompt each time the integration is run.

- Yes whenever this QuickBooks company file is open.- You will need to make sure the intended QuickBooks company file is opened and running when the export is run.

- Yes, always, allow access even if QuickBooks is not running.- You do not need to open QuickBooks or the company file for the integration to run.

Once this is allowed, the communication interval can be configured in the Every-Min box (defaulted to 120 minutes). This will determine the amount of time the communications from Heartland Restaurant and the QuickBooks Company File will occur.

You may manually push data by selecting the check box to the left of the Heartland Restaurant integration and choose the Update Selected button on the top bar.

The communication will only transfer data with the QuickBooks Company File opened and the QuickBooks Web Connector running. If one of these are not running, no data will transfer.

QuickBooks Configuration Mapping

- When mapping your QuickBooks configuration in the Admin Console, fill all of the required fields. The Items that are mapped in QuickBooks will need to match exactly as they are in the mapping selection in the Admin Console.

- There are some Account Types available in Quickbooks associated with a QB Item that are not supported on a Sales Receipt.

- Make sure that the mapped items do not overlap as it may cause duplicate values.

- If a field is not used, you still need to create a mapped item for it. In the scenario it is unintentionally selected, it will be easily distinguishable to reconcile.

- If you add things or make changes in QuickBooks you may have to refresh or access another section in the Heartland Restaurant Admin Console in order for those new changes to be visible.

Overrides

The Overrides section will provide you the ability to select a type of override: Report Categories, Discounts, Auto Pricing, Adjustments, Taxes and Payments. Each type will allow you to use a corresponding Menu Mapping list respective to the type selected. These can be created and mapped at the initial integration or at any time they chose to later map and add/change an override.

In the example below these tender types can be broken down to export to QuickBooks specific Items.

The other override types will directly correlate with the location’s database. For example, if Taxes is selected as an Override Type the Menu Mapping column will dropdown with an auto populated selection of the taxes that have been created in the Heartland Restaurant Menu. This logic will follow the remaining available Override Types. Once everything is mapped it is good practice to run the export the first time manually with the QuickBooks Web Connector (Desktop integration) or Test Export button (Online integration), to make sure there are no errors.

QuickBooks Export Recommendations

Successful Export

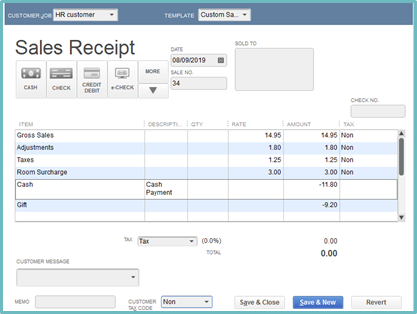

We recommend you run a test export after completing and mapping both Online and Desktop integration to ensure there are no errors in the mapping.

Below is an example of a successful export. The Sales Receipt is properly balanced to $0.00 and showing line items for the Items/Products mapped for the date exported.

QuickBooks Integration Information & Recommendation

- If you are not using a mapping field in the integration (such as Tips), it is still suggested you create its own designated item in QuickBooks as opposed to selecting one that is already mapped.

- QuickBooks sub accounts are not supported to be mapped to an Item/Product.

- When selecting a QuickBooks item type, set as a Service Item type or a Payments Type

- If the location is getting an error when using the integration check they do not have tax assigned to the customer that is mapped in Admin Portal, QuickBooks.